The palm oil business in Nigeria is one of the most profitable ventures today, not just because of its cultural relevance, but also because of its rising global demand.

According to the United States Department of Agriculture (USDA), Nigeria currently ranks as the fifth-largest producer of palm oil worldwide, with annual output exceeding 1.4 million metric tonnes. Yet, demand continues to outpace supply, creating a consistent market for producers, processors, and distributors alike.

Starting a palm oil business in Nigeria is a fantastic venture, especially with the increasing global demand for this versatile product. With the right knowledge, planning, and execution, you can tap into a market that not only promises profits but also contributes significantly to the local economy. The palm oil industry presents a lucrative opportunity for entrepreneurs in Nigeria. As one of the most widely consumed cooking oils in Nigeria, the demand for palm oil is consistently high.

Palm Oil Industry Market Research

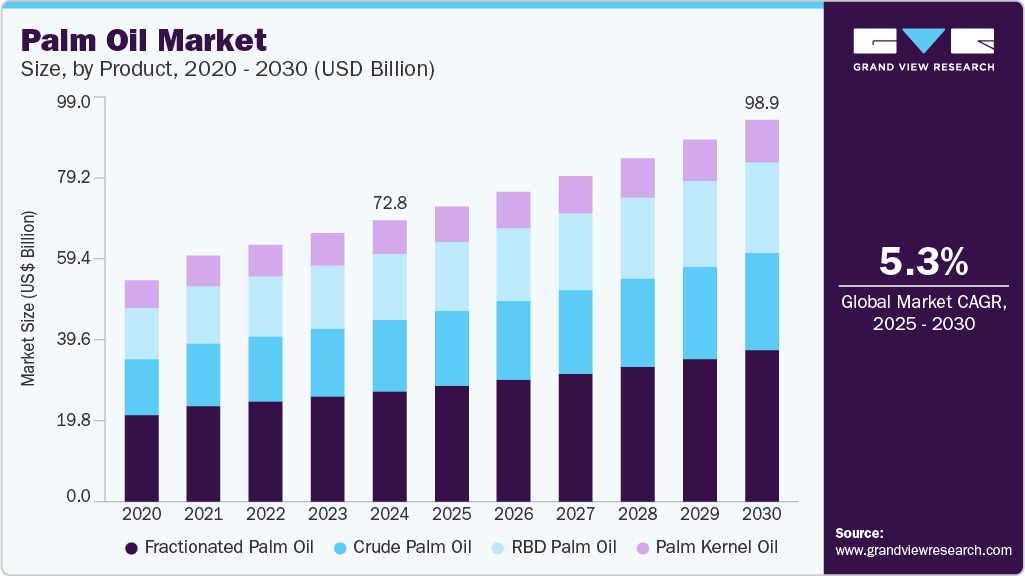

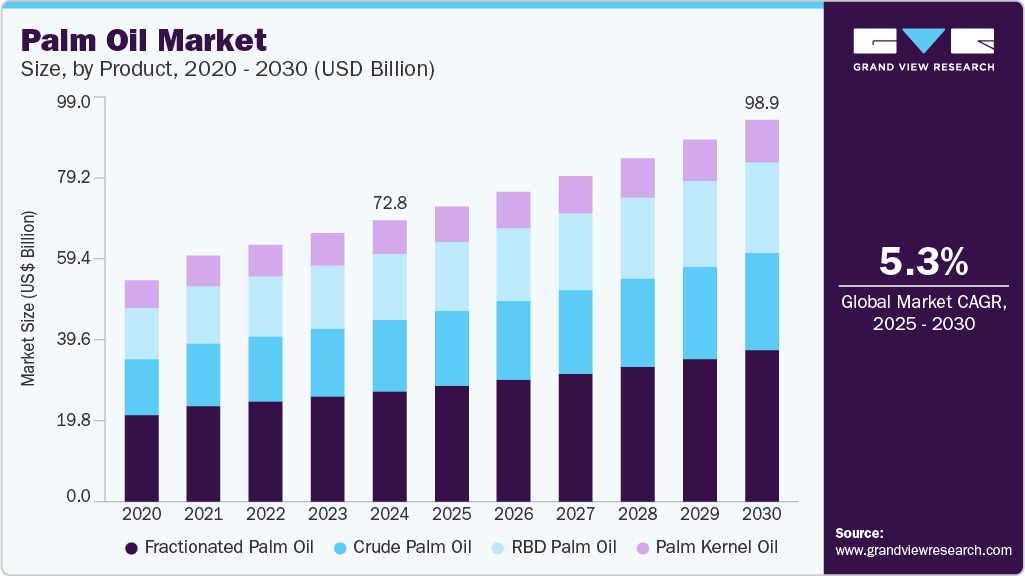

The global palm oil market size was estimated at USD 72,844.8 million in 2024 and is projected to grow at a CAGR of 5.3% from 2025 to 2030. The market is driven by exponentially growing demand from the food, beverage, biofuel, energy, personal care, and cosmetics industries.

Key Highlights:

- Asia Pacific dominated the palm oil market with the largest revenue share of 71.18% in 2024.

- The India palm oil market accounted for the largest revenue share of over 20.2% in Asia Pacific in 2024.

- By nature, the conventional segment led the market with the largest revenue share of 99.06% in 2024.

- By product, the fractionated segment led the market with the largest revenue share of 39.23% in 2024.

- By end-use, the food & beverages segment led the market with the largest revenue share of 65.98% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 72,844.8 Million

- 2030 Projected Market Size: USD 98,906.06 Million

- CAGR (2025-2030): 5.3%

- Asia Pacific : Largest market in 2024

- Capacity: 500 kg/h to 2 tons/h

- Cost: ₦6–12 million ($13,200–26,400) for basic models .

- Advantages:

- Low Initial Investment: Ideal for smallholders or startups with limited capital.

- Portability: Easy to install and operate in rural areas.

- Local Availability: Suppliers like Global Machines Nigeria and QIE Machinery offer affordable options.

- Limitations:

- Lower oil extraction rates (18–20% FFA) compared to hydraulic presses.

- Higher labor dependency for manual feeding and maintenance.

- Capacity: 10–30 tons/h

- Cost: ₦1–5 billion ($2.2–11 million) for turnkey solutions .

- Components:

- Sterilizers, digesters, clarifiers, and refining units.

- QIE Machinery (China)’s smart presses feature PLC-controlled automation, reducing labor by 30% and extending screw lifespan to 9 months (vs. 3 months for traditional imports) .

- Target Markets:

- Export to EU markets (requires RSPO certification) and local industries (e.g., food processing).

Establishing a palm oil processing plant in Nigeria requires a strategic blend of cutting-edge technology, regulatory compliance, and market alignment. Below is a comprehensive guide tailored to Nigeria’s evolving landscape, incorporating the latest industry advancements and actionable insights for 2025:

A modern

palm oil processing plant in Nigeria consists of

six critical stages, each requiring specialized equipment and optimized workflows:

- Function: Kills enzymes to prevent oil degradation and softens fruit bunches for extraction.

- Technology:

- Continuous Sterilizers: Gas-fired units (₦50–150 million) with 5–10 ton/h capacity, reducing FFA levels by 12% compared to traditional methods .

- IoT Integration: Smart sensors monitor temperature (120–130°C) and pressure in real time, minimizing energy consumption by 20% .

- Equipment:

- Mechanical Threshers: ₦30–80 million, separating fruits from bunches with 98% efficiency.

- Digesters: Stainless steel tanks (₦40–100 million) that cook fruits for 45–60 minutes to release oil .

- Hydraulic Presses:

- Hua Tai’s Smart Press: PLC-controlled units (₦200–500 million) extract 25–30% oil from FFB, with AI-driven maintenance alerts .

- Clarifiers: Centrifugal separators (₦30–70 million) reduce moisture to <0.5% in crude palm oil (CPO) .

- Full Refining Lines:

- Bleaching Towers: Remove pigments using activated clay (₦80–200 million).

- Deodorizers: Steam stripping units (₦150–400 million) meet EU food-grade standards (FFA <0.2%) .

- Packaging:

- Automated Filling Systems: ₦50–120 million for 5–20 liter pouch packing, targeting Nigeria’s retail sector .

- EFB Pelletizers: Convert empty fruit bunches into biomass pellets (₦40–90 million), generating 15% of plant energy needs .

- Biochar Kilns: Produce soil amendments from EFB (₦30–70 million), adding ₦5–10 million/year in revenue .

- Near-Infrared (NIR) Analyzers: ₦20–50 million for real-time oil quality checks (FFA, iodine value) .

- Small-Scale (2–5 ton/h): ₦300–800 million ($660,000–$1.76 million)

- Medium-Scale (10–20 ton/h): ₦1.5–3 billion ($3.3–6.6 million)

- Large-Scale (30+ ton/h): ₦5–15 billion ($11–33 million)

Breakdown:

- Equipment: 60–70% of CAPEX

- Infrastructure: 20–25% (buildings, utilities)

- Contingency: 10–15%

- Labor: ₦15–30 million/month for 50–100 workers (₦30,000–50,000/month per employee) .

- Energy: ₦8–15 million/month (diesel/biomass) for medium-scale plants.

- Maintenance: 5–8% of CAPEX annually.

- CBN AgriTech Fund: 7% interest loans for processing equipment (2025 update) .

- World Bank Agri-Partnerships: Grants covering 30–50% of CAPEX for sustainable projects .

- Local Investors: Equity partnerships with firms like Okomu Oil Palm for joint ventures.

- Nigeria Agricultural Quarantine Service (NAQS): Phytosanitary certificates for exports (₦50,000–100,000 per batch) .

- RSPO Supply Chain Certification:

- Identity Preserved (IP): Costly ($20,000–50,000) but commands 15–20% premium in EU markets.

- Mass Balance (MB): Cheaper ($5,000–15,000) for bulk exports to Asia .

- ISO 22000: Food safety certification (₦2–5 million) for domestic supermarket chains.

- Zero Burning Policy: Fines up to ₦50 million for burning EFB; adopt pelletization instead .

- Effluent Treatment: Construct biogas digesters (₦20–50 million) to treat wastewater, reducing COD levels by 90% .

- Retail Channels: Partner with Jumia and Shoprite for 5–20 liter packs (₦1,500–3,000/liter).

- Industrial Sales: Supply Flour Mills of Nigeria (₦120,000–150,000/ton) for bakery and detergent production.

- EU:

- RSPO-IP certified CPO sells at $900–1,100/ton (vs. $700–800/ton for non-certified) .

- EUDR compliance requires blockchain traceability (e.g., IBM Food Trust), costing ₦3–5 million to implement .

- West Africa:

- Duty-free exports to Ghana and Ivory Coast via ECOWAS protocols (tariff reduced from 20% to 5% in 2025) .

- Organic Palm Oil: Certify through NAQS Organic Scheme (₦1–3 million) and sell at ₦2,500–4,000/liter on Konga.

- Palm Kernel Oil: Extract via screw presses (₦20–50 million) and export to cosmetics firms in India (₦180,000–220,000/ton) .

- IoT Sensors: Monitor sterilizer temperature and press oil output in real time, reducing downtime by 30% .

- AI-Powered Analytics: Predict equipment failures (e.g., Hua Tai’s Predictive Maintenance Platform) and optimize FFB intake .

- Biomass Boilers: Use palm kernel shells to generate 80% of plant steam, cutting energy costs by 40% .

- Solar Panels: Install 500–1,000 kW systems (₦150–300 million) for off-grid operations in rural areas .